COVID-19 may have lost its daily news headline status, but the disease rages on with 2700 weekly deaths in the U.S. and millions of Americans chronically disabled from long-COVID, 4 million of which are being kept from work. This winter time, a terrible year for RSV as well as a potentially worse flu season could add insult to injury especially when one considers the fact that COVID-19 leaves some people with an impaired immune system similar to what HIV does to cause AIDS. The multiplication of disease could amplify the risks of influenza and RSV to result in more severe cases of these diseases which may result in increased deaths and morbidity. And that isn’t something our country nor the world can afford. There are already reports of Tamiflu generics being in short supply, and it’s just barely the New Year. Fortunately, there are several biotech and pharma companies advancing solutions for RSV, flu, and COVID, including two that may have a solution for all three of these viruses that are currently plaguing the U.S. However, deciding which ones are worth an investment in is not necessarily an easy task.

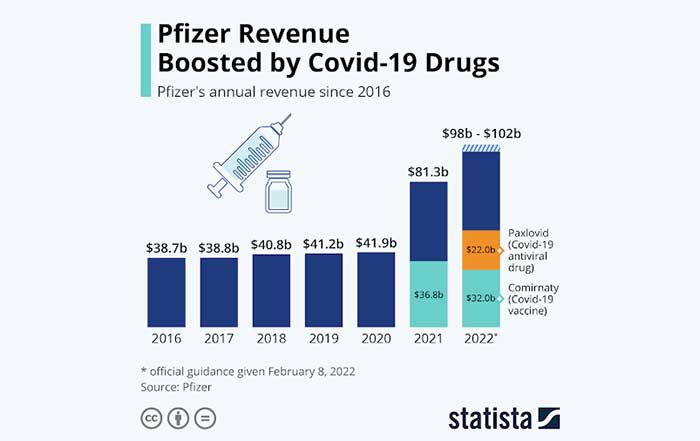

The first company that everyone thinks of when considering COVID-19 solutions is Pfizer (NYSE: PFE). With the Comirnaty COVID vaccine and 3CL inhibitor Paxlovid, the company’s COVID antiviral, the company is in a market-leading position for COVID, raking in tens of billions in revenues for both products. What is less well-known is that Pfizer is also on a roll with RSV. The company announced in November that its RSV vaccine candidate used in maternal immunization for infants was effective against infant death, making it likely the first available maternal vaccine to protect against infant RSV death. The vaccine is also effective in older adults. And if that weren’t already enough, the company acquired ReViral and its RSV therapeutics for $525 million, including upfront and milestone payments, with an expectation that the therapeutics would bring in $1.5 billion to Pfizer. ReViral’s main candidate is a fusion inhibitor sisunatovir which is in phase 2. Pfizer is also initiating a phase 3 study for its influenza vaccine, making it a leader in the tripledemic. Indeed, its 2022 COVID revenue is expected to be over $50 billion.

Big Pharma competitors GSK (NYSE: GSK) and Roche are also key players in the tripledemic race. Roche was the initial innovator of the influenza antiviral blockbuster, Tamiflu, but the company has made recent progress with COVID, too. The company is well known for its IL-6 inhibitor (an anti-inflammatory monoclonal antibody) approval in severe COVID-19. For next steps against influenza, the company has developed a new therapeutic called baloxavir marboxil, aka Xofluza, which unfortunately has some severe drawbacks in causing drug resistance mutations at quite a high rate such that it’s not necessarily a good choice for kids. This could derail its blockbuster follow-up to the Tamiflu success seen years ago. Roche is certainly outshined by Pfizer in the Tripledemic race.

GSK’s progress is more straightforward. Known for its prowess in the antiviral space, GSK was granted a priority review and PDUFA date of May 23, 2023 from the FDA due to its RSV vaccine candidate achieving a high 82.6% efficacy in its pivotal trial. The company has early stage monoclonal antibodies and vaccines against influenza, as well as late-stage studies for COVID-19 vaccines and neutralizing antibodies. What’s missing are antiviral candidates for the diseases, and so while one might call GSK a leader in the tripledemic, they are also outshined by Pfizer.

One smaller company, Icosavax (NASDAQ: ICVX), is advancing vaccine candidates for all three diseases, but the one drawback is that they’re not past phase 1 for any of their candidates.

The company’s secret sauce lies in its VLP (virus-like particle), which allows viral proteins to be assembled more similarly to an actual virus and is supposed to improve the immune response compared to vaccines that use these proteins alone, like mRNA vaccines. The company recently hit the headlines with positive phase 1 clinical trial results for its RSV vaccine with sustained neutralizing antibody responses through 6 months; durability of response was a key reason for developing VLP vaccines. Icosavax is moving forward with this vaccine in combination with its hMPV virus-like particles as the only vaccine for the elderly population targeting the two leading causes of pneumonia. ICVX is particularly well funded with $229 million in current assets reported at the end of Q3 2022, which appears sufficient to support the company for more or less than 2 years based on their current burn rate.

Unfortunately, for common yearly diseases like COVID, influenza, and RSV, vaccines are only a partial answer. Another small pharma company, Bioxytran Inc. (OTCMKTS: BIXT), might have antiviral treatment solutions for all three viruses. Bioxytran recently released slam-dunk results from their ProLectin-M antiviral, which had a 100% response rate reducing the viral load of COVID-19 patients to undetectable levels in just a few days, effectively curing every single patient on the drug. These results are unprecedented and quite possibly the best COVID antiviral results ever recorded. The company’s drugs are made using carbohydrate chemistry which usually means a benign safety profile. Unbeknownst to most investors, the company appears to be working on or considering treating other viruses including influenza and RSV, and if BIXT can show its RSV and influenza antivirals work like its COVID antiviral, then the company would have multiple potential blockbuster products. ProLectin-M is a phase 3 ready drug with results expected in 2023.

These leading tripledemic companies are focusing on the current and future problems facing the nation. But when it comes to investment risk and reward, there are two clear winners. With respect to the bigger pharma companies with established sales, Pfizer is by far the undisputed COVID-19 champion with a forward P/E ratio of ~8x compared with GSK at ~11 and Roche at ~14. Market leadership typically comes with a premium price tag so Pfizer is clearly the best value when looking at market leadership and forward price/earnings ratios.

However, multi-bagger returns are unlikely to be seen with big pharma. Bioxytran, however, appears to be a smaller biotech that could return multiples to investors. Big Pharma is licensing COVID-19 antiviral candidates from various biotech companies for hundreds of millions in deal value, and some of these companies are already worth that in market capitalization. When considering the value of each of the companies, Bioxytran stands out with just a $50 million market capitalization and a phase 3 ready COVID-19 antiviral that appears to best Paxlovid in effectiveness. This compares favorably to Icosavax’s $350 million market cap based on three phase 1 assets. With positive phase 3 results or a pharma licensing agreement, BIXT shares could see a rerating higher, potentially to the much more reasonable $350 million dollar range, or 7x the current price.